Understanding historic inflation trends

From gas to groceries, prices are going up with the U.S reaching inflation levels never seen before - and the insurance industry is not immune to this trend. Many current conditions, including increased costs of material and labor, as well as an ongoing shortage of workers means you may see a rise in your premiums at renewal time.

We've compiled some resources to help you better understand the many factors that impact rising costs, as well as tips on what to consider talking about with your independent agent.

Contributing factors

Home insurance

Higher material costs

Higher labor costs

More firms experiencing project delays

Workforce shortages

Supply chain and shipping delays

Auto insurance

Higher prices for used and new cars

Increased repair costs

Increased labor costs

Rise in the cost of car parts

Increase in rental car costs

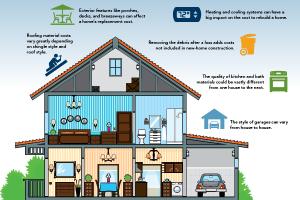

See infographic

Frequently asked questions

- Why are home insurance rates going up?

Home insurance premiums can be affected by influencers outside of your control. Various nationwide factors are impacting the cost to rebuild homes, leading to the need for more coverage in case of a claim.

Some of the trends that are driving up costs include higher material costs and supply chain issues. For instance, materials to rebuild homes are up 26%. Labor shortages are resulting in longer construction and claims handling times, which also impact the cost of claims.

See our infographic on the historic inflation trend for more insight.

- How do the current trends impact my home insurance costs?

Like most insurers, The Hanover includes an inflation factor to reduce the risk of being underinsured. With the increased material and labor costs to rebuild a home, you may need more home insurance coverage than before in case of a total loss. For Hanover customers, a home policy includes the added benefit of inflation factors so that your coverage increases to help reduce your risk of being underinsured in case of the unexpected. As your coverage increases, your premiums may also adjust to match.

If you have made any home renovations which may require more protection, it’s important to update your coverage appropriately. In addition, you may find that due to labor shortages, shipping delays and other factors, it takes longer for claims, service, inspections and underwriting to be completed.

- What should I do if I have questions about my home insurance coverage or premium?

Look at your Coverage A: dwelling on your home insurance. This is the amount of coverage needed to rebuild your home in case of a total loss. You can compare the coverage you had last year to this year to see the difference in protection your policy now includes. It’s important to remember that this is different than the market value of your home.

Reach out to your independent agent to do an annual insurance review to make sure you have the right coverage in the event of a loss, and enough of it, especially if you’ve done any renovations to your home recently that may not be accounted for in your current protection.

- How can I save on my home insurance?

Review options to lower your premium with an agent. This could include changing your deductible or adding discounts you’re not receiving. For instance, bundling your home and auto coverage can provide value and convenience by having multiple policies with The Hanover.

If you have a low deductible, your premiums will be higher but you may pay less out of pocket expenses. By raising your deductible, your premiums will be lower but in the event of a loss, you may need to pay for higher, unexpected expenses.

See our Make the most of your insurance dollars infographic for more tips.

- Will I save more if I move to another insurance company?

The national trends impacting insurance costs are reaching carriers across the country. However, if you choose to shop your insurance, remember that switching to another carrier may provide temporary savings, but you may lose coverage or create coverage gaps as well as miss out on any loyalty benefits with The Hanover.

For instance, many Hanover packages come with various coverage benefits built in. It’s important to review any new quotes with your independent agent to understand coverage or service differences that may not be obvious at first glance.

- Is home insurance the only coverage impacted by current trends?

Auto insurance is also experiencing increases due to national trends. Used car prices are up 40%, the cost of labor for repairs is up, car parts are costlier and harder to obtain due to supply chain issues, and rental car costs are up 30%.

These factors and others are contributing to a rise in auto insurance rates.

- Does The Hanover have any resources to help me manage my account?

The Hanover has several digital tools such as self-inspections, paperless billing and policy documents and self-service for claims and billing. Taking advantage of these tools may help avoid delays due to labor shortages and postal delivery times.

Your independent agent is the best resource for all your insurance needs. Set up time with your independent agent to ensure that you have the right coverage. The Hanover works hard to offer offers pricing stability to give you peace of mind at renewal time.

Resource library

Explore our customer resource library to find materials and articles to help understand the trends, learn about the value of your current coverage, and find the right coverage if you need to update your policy.

Inflation is headed for historic levels in 2022. What factors are impacting home and auto rates?