The answers to all your questions about cyber insurance for homeowners

We get it - understanding how to best protect yourself online can be confusing. That's why The Hanover believes that cyber protection begins at home. See what The Hanover's cyber coverage for homeowners does and why it's so important to have it.

What is cyber insurance for homeowners?

Our home cyber protection aids you with recovery and related expenses resulting from a cyberattack, data breach, online fraud, cyber extortion or cyberbullying event affecting you or family members on your policy.

Additionally, this coverage applies to cell phones, tablets, and any smart device connected to your account. This includes, and is not limited to, wearables, thermostats, entertainment systems, home security devices, smart appliances and much more.

How does cyber insurance differ from cyber protection from a third-party (e.g. Lifelock)? Or the cyber coverage I have on my current home policy?

The main difference is that third-party cyber security vendors provide support and direction, but don't reimburse costs related to recovering from a breach or hack. The Hanover partners with CyberScout to offer these types of cyber protection services. But, with our home cyber protection coverage, you benefit from these services and reimbursement in the wake of a covered cyber event for costs you incur in the recovery process.

Does cyber insurance for homeowners apply if I run a business out of my home? Or if I work from home?

This coverage only applies to cyber incidents and losses of a personal nature, and not associated with your work or a business you operate. For business owners, Hanover home business solutions offers a suite of packages that can be chosen a la carte, based on the nature of your business.

Do I need to be a Hanover home insurance customer to add this coverage?

Yes. Also consider that having all of your personal insurance needs with one company can translate into cost savings for you, and the convenience of just one bill to pay and one number in the event of a claim. The Hanover offers coverage add-ons (called "endorsements") for watercraft, motorcycles, specific valuable items such as art collections or wine cellars, and much more. Talk to your agent to see how The Hanover can provide a one-company solution for your personal insurance needs, or find an agent near you.

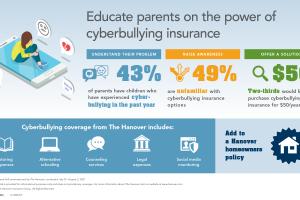

What is cyberbullying?

Stopbullying.gov defines cyberbullying as sending, posting, or sharing negative, harmful, false, or mean content about someone else using digital devices like cell phones, computers, and tablets. Cyberbullying can affect people of any age, but teens tend to bear the brunt of it. In fact, the Centers for Disease Control and Prevention reports that roughly 1 in 6 high school students experienced cyberbullying within the last 12 months.

For the purposes of our coverage, cyberbullying is defined as:

Two or more similar or related acts of...

- Harassment

- Intimidation

- Defamation

- Invasion of privacy

- Threats of violence

...that are carried out using...

- Computers

- Cell phones

- Tablets

- Similar smart devices

The Hanover's cyber coverage for homeowners protects against expenses related to a cyberbullying event, including temporary private tutoring and relocation to an alternate school.

How much does cyber insurance usually cost?

There are many different factors that can affect the cost of our cyber insurance for homeowners, including the fact that we offer coverage options ranging up to $100,000 in protection. But no matter how much you need, you will likely find our cyber coverage affordable, as well as valuable. Contact your local independent agent for a quote on a homeowners insurance policy that includes this important coverage.

Additional questions?

Talk to your independent insurance agent about your options for cyber coverage for your home. You can also find additional details on our cyber coverage for homeowners page.

All products are underwritten by The Hanover Insurance Company or one of its insurance company subsidiaries or affiliates (“The Hanover”). Coverage may not be available in all jurisdictions and is subject to the company underwriting guidelines and the issued policy. This material is provided for informational purposes only and does not provide any coverage. Visit our website, hanover.com, for more information about The Hanover.

LC 2021-235

Related resources

The answers to all your questions about cyber insurance for homeowners

We get it - understanding how to best protect yourself online can be confusing. That's why The Hanover believes that cyber protection begins at home. See what The Hanover's cyber coverage for homeowners does and why it's so important to have it.

What is cyber insurance for homeowners?

Our home cyber protection aids you with recovery and related expenses resulting from a cyberattack, data breach, online fraud, cyber extortion or cyberbullying event affecting you or family members on your policy.

Additionally, this coverage applies to cell phones, tablets, and any smart device connected to your account. This includes, and is not limited to, wearables, thermostats, entertainment systems, home security devices, smart appliances and much more.

How does cyber insurance differ from cyber protection from a third-party (e.g. Lifelock)? Or the cyber coverage I have on my current home policy?

The main difference is that third-party cyber security vendors provide support and direction, but don't reimburse costs related to recovering from a breach or hack. The Hanover partners with CyberScout to offer these types of cyber protection services. But, with our home cyber protection coverage, you benefit from these services and reimbursement in the wake of a covered cyber event for costs you incur in the recovery process.

Does cyber insurance for homeowners apply if I run a business out of my home? Or if I work from home?

This coverage only applies to cyber incidents and losses of a personal nature, and not associated with your work or a business you operate. For business owners, Hanover home business solutions offers a suite of packages that can be chosen a la carte, based on the nature of your business.

Do I need to be a Hanover home insurance customer to add this coverage?

Yes. Also consider that having all of your personal insurance needs with one company can translate into cost savings for you, and the convenience of just one bill to pay and one number in the event of a claim. The Hanover offers coverage add-ons (called "endorsements") for watercraft, motorcycles, specific valuable items such as art collections or wine cellars, and much more. Talk to your agent to see how The Hanover can provide a one-company solution for your personal insurance needs, or find an agent near you.

What is cyberbullying?

Stopbullying.gov defines cyberbullying as sending, posting, or sharing negative, harmful, false, or mean content about someone else using digital devices like cell phones, computers, and tablets. Cyberbullying can affect people of any age, but teens tend to bear the brunt of it. In fact, the Centers for Disease Control and Prevention reports that roughly 1 in 6 high school students experienced cyberbullying within the last 12 months.

For the purposes of our coverage, cyberbullying is defined as:

Two or more similar or related acts of...

- Harassment

- Intimidation

- Defamation

- Invasion of privacy

- Threats of violence

...that are carried out using...

- Computers

- Cell phones

- Tablets

- Similar smart devices

The Hanover's cyber coverage for homeowners protects against expenses related to a cyberbullying event, including temporary private tutoring and relocation to an alternate school.

How much does cyber insurance usually cost?

There are many different factors that can affect the cost of our cyber insurance for homeowners, including the fact that we offer coverage options ranging up to $100,000 in protection. But no matter how much you need, you will likely find our cyber coverage affordable, as well as valuable. Contact your local independent agent for a quote on a homeowners insurance policy that includes this important coverage.

Additional questions?

Talk to your independent insurance agent about your options for cyber coverage for your home. You can also find additional details on our cyber coverage for homeowners page.

All products are underwritten by The Hanover Insurance Company or one of its insurance company subsidiaries or affiliates (“The Hanover”). Coverage may not be available in all jurisdictions and is subject to the company underwriting guidelines and the issued policy. This material is provided for informational purposes only and does not provide any coverage. Visit our website, hanover.com, for more information about The Hanover.

LC 2021-235

Related resources

The answers to all your questions about cyber insurance for homeowners

We get it - understanding how to best protect yourself online can be confusing. That's why The Hanover believes that cyber protection begins at home. See what The Hanover's cyber coverage for homeowners does and why it's so important to have it.

What is cyber insurance for homeowners?

Our home cyber protection aids you with recovery and related expenses resulting from a cyberattack, data breach, online fraud, cyber extortion or cyberbullying event affecting you or family members on your policy.

Additionally, this coverage applies to cell phones, tablets, and any smart device connected to your account. This includes, and is not limited to, wearables, thermostats, entertainment systems, home security devices, smart appliances and much more.

How does cyber insurance differ from cyber protection from a third-party (e.g. Lifelock)? Or the cyber coverage I have on my current home policy?

The main difference is that third-party cyber security vendors provide support and direction, but don't reimburse costs related to recovering from a breach or hack. The Hanover partners with CyberScout to offer these types of cyber protection services. But, with our home cyber protection coverage, you benefit from these services and reimbursement in the wake of a covered cyber event for costs you incur in the recovery process.

Does cyber insurance for homeowners apply if I run a business out of my home? Or if I work from home?

This coverage only applies to cyber incidents and losses of a personal nature, and not associated with your work or a business you operate. For business owners, Hanover home business solutions offers a suite of packages that can be chosen a la carte, based on the nature of your business.

Do I need to be a Hanover home insurance customer to add this coverage?

Yes. Also consider that having all of your personal insurance needs with one company can translate into cost savings for you, and the convenience of just one bill to pay and one number in the event of a claim. The Hanover offers coverage add-ons (called "endorsements") for watercraft, motorcycles, specific valuable items such as art collections or wine cellars, and much more. Talk to your agent to see how The Hanover can provide a one-company solution for your personal insurance needs, or find an agent near you.

What is cyberbullying?

Stopbullying.gov defines cyberbullying as sending, posting, or sharing negative, harmful, false, or mean content about someone else using digital devices like cell phones, computers, and tablets. Cyberbullying can affect people of any age, but teens tend to bear the brunt of it. In fact, the Centers for Disease Control and Prevention reports that roughly 1 in 6 high school students experienced cyberbullying within the last 12 months.

For the purposes of our coverage, cyberbullying is defined as:

Two or more similar or related acts of...

- Harassment

- Intimidation

- Defamation

- Invasion of privacy

- Threats of violence

...that are carried out using...

- Computers

- Cell phones

- Tablets

- Similar smart devices

The Hanover's cyber coverage for homeowners protects against expenses related to a cyberbullying event, including temporary private tutoring and relocation to an alternate school.

How much does cyber insurance usually cost?

There are many different factors that can affect the cost of our cyber insurance for homeowners, including the fact that we offer coverage options ranging up to $100,000 in protection. But no matter how much you need, you will likely find our cyber coverage affordable, as well as valuable. Contact your local independent agent for a quote on a homeowners insurance policy that includes this important coverage.

Additional questions?

Talk to your independent insurance agent about your options for cyber coverage for your home. You can also find additional details on our cyber coverage for homeowners page.

All products are underwritten by The Hanover Insurance Company or one of its insurance company subsidiaries or affiliates (“The Hanover”). Coverage may not be available in all jurisdictions and is subject to the company underwriting guidelines and the issued policy. This material is provided for informational purposes only and does not provide any coverage. Visit our website, hanover.com, for more information about The Hanover.

LC 2021-235

Related resources

The answers to all your questions about cyber insurance for homeowners

We get it - understanding how to best protect yourself online can be confusing. That's why The Hanover believes that cyber protection begins at home. See what The Hanover's cyber coverage for homeowners does and why it's so important to have it.

What is cyber insurance for homeowners?

Our home cyber protection aids you with recovery and related expenses resulting from a cyberattack, data breach, online fraud, cyber extortion or cyberbullying event affecting you or family members on your policy.

Additionally, this coverage applies to cell phones, tablets, and any smart device connected to your account. This includes, and is not limited to, wearables, thermostats, entertainment systems, home security devices, smart appliances and much more.

How does cyber insurance differ from cyber protection from a third-party (e.g. Lifelock)? Or the cyber coverage I have on my current home policy?

The main difference is that third-party cyber security vendors provide support and direction, but don't reimburse costs related to recovering from a breach or hack. The Hanover partners with CyberScout to offer these types of cyber protection services. But, with our home cyber protection coverage, you benefit from these services and reimbursement in the wake of a covered cyber event for costs you incur in the recovery process.

Does cyber insurance for homeowners apply if I run a business out of my home? Or if I work from home?

This coverage only applies to cyber incidents and losses of a personal nature, and not associated with your work or a business you operate. For business owners, Hanover home business solutions offers a suite of packages that can be chosen a la carte, based on the nature of your business.

Do I need to be a Hanover home insurance customer to add this coverage?

Yes. Also consider that having all of your personal insurance needs with one company can translate into cost savings for you, and the convenience of just one bill to pay and one number in the event of a claim. The Hanover offers coverage add-ons (called "endorsements") for watercraft, motorcycles, specific valuable items such as art collections or wine cellars, and much more. Talk to your agent to see how The Hanover can provide a one-company solution for your personal insurance needs, or find an agent near you.

What is cyberbullying?

Stopbullying.gov defines cyberbullying as sending, posting, or sharing negative, harmful, false, or mean content about someone else using digital devices like cell phones, computers, and tablets. Cyberbullying can affect people of any age, but teens tend to bear the brunt of it. In fact, the Centers for Disease Control and Prevention reports that roughly 1 in 6 high school students experienced cyberbullying within the last 12 months.

For the purposes of our coverage, cyberbullying is defined as:

Two or more similar or related acts of...

- Harassment

- Intimidation

- Defamation

- Invasion of privacy

- Threats of violence

...that are carried out using...

- Computers

- Cell phones

- Tablets

- Similar smart devices

The Hanover's cyber coverage for homeowners protects against expenses related to a cyberbullying event, including temporary private tutoring and relocation to an alternate school.

How much does cyber insurance usually cost?

There are many different factors that can affect the cost of our cyber insurance for homeowners, including the fact that we offer coverage options ranging up to $100,000 in protection. But no matter how much you need, you will likely find our cyber coverage affordable, as well as valuable. Contact your local independent agent for a quote on a homeowners insurance policy that includes this important coverage.

Additional questions?

Talk to your independent insurance agent about your options for cyber coverage for your home. You can also find additional details on our cyber coverage for homeowners page.

All products are underwritten by The Hanover Insurance Company or one of its insurance company subsidiaries or affiliates (“The Hanover”). Coverage may not be available in all jurisdictions and is subject to the company underwriting guidelines and the issued policy. This material is provided for informational purposes only and does not provide any coverage. Visit our website, hanover.com, for more information about The Hanover.

LC 2021-235