Tornado preparation and safety tips for homeowners

Learn ways to prepare your home before, during and after a tornado.

Sources:

Insurance Information Institute

These essential tips, developed by The Hanover, provide important guidelines to help you prevent the most common weather-related damage that may occur during a tornado. Bookmark this page to refer to these tips regularly, to help avoid or reduce the effects of a tornado on your home and vehicles.

Tornado preparation and safety tips for homeowners

Learn ways to prepare your home before, during and after a tornado.

Sources:

Insurance Information Institute

These essential tips, developed by The Hanover, provide important guidelines to help you prevent the most common weather-related damage that may occur during a tornado. Bookmark this page to refer to these tips regularly, to help avoid or reduce the effects of a tornado on your home and vehicles.

Tornado preparation and safety tips for homeowners

Learn ways to prepare your home before, during and after a tornado.

Sources:

Insurance Information Institute

These essential tips, developed by The Hanover, provide important guidelines to help you prevent the most common weather-related damage that may occur during a tornado. Bookmark this page to refer to these tips regularly, to help avoid or reduce the effects of a tornado on your home and vehicles.

- View transcript

-

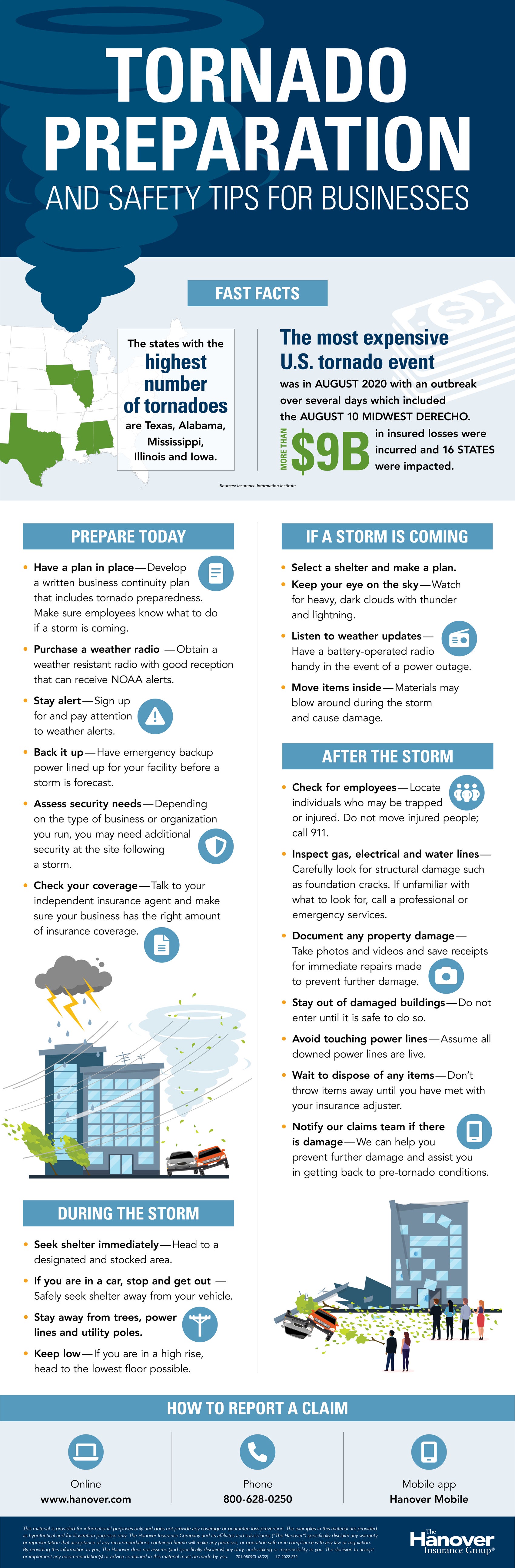

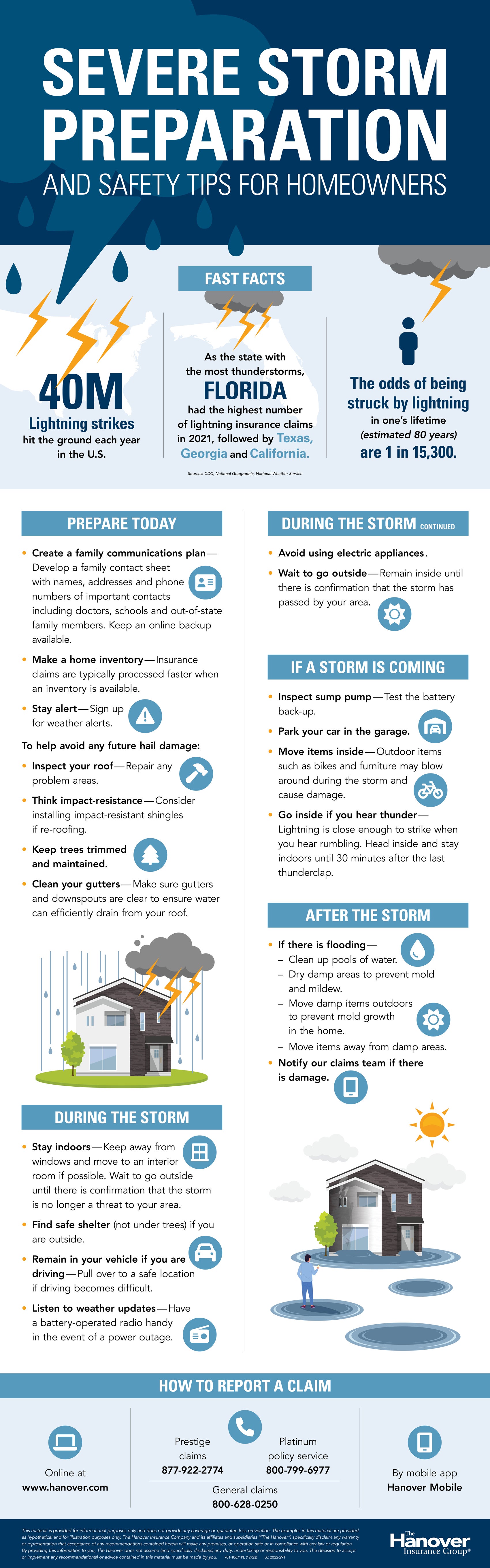

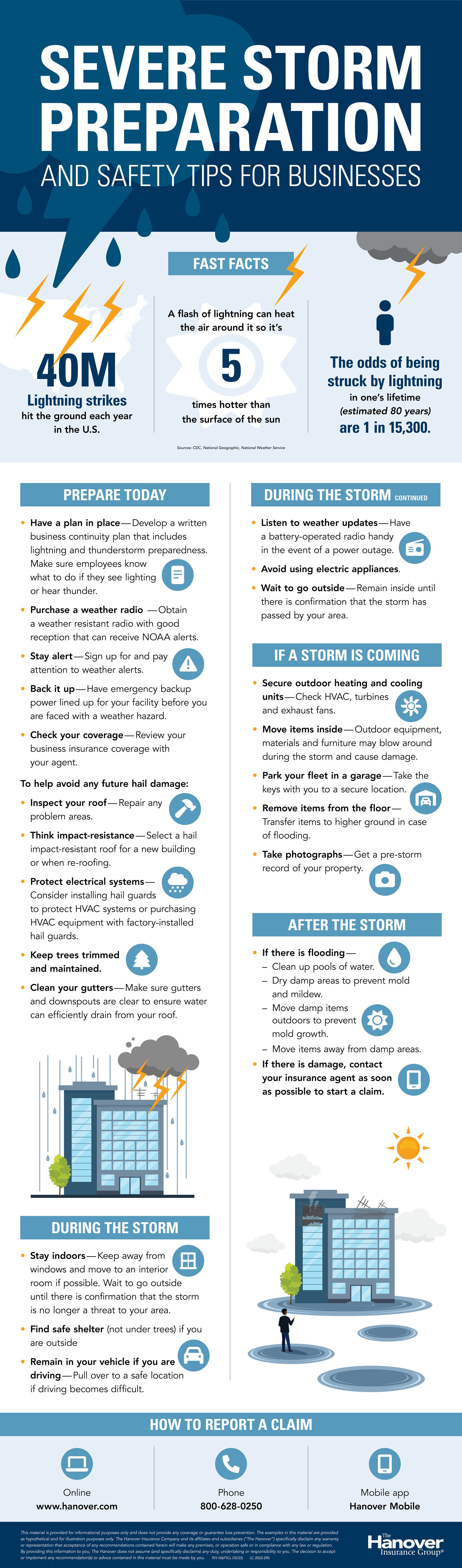

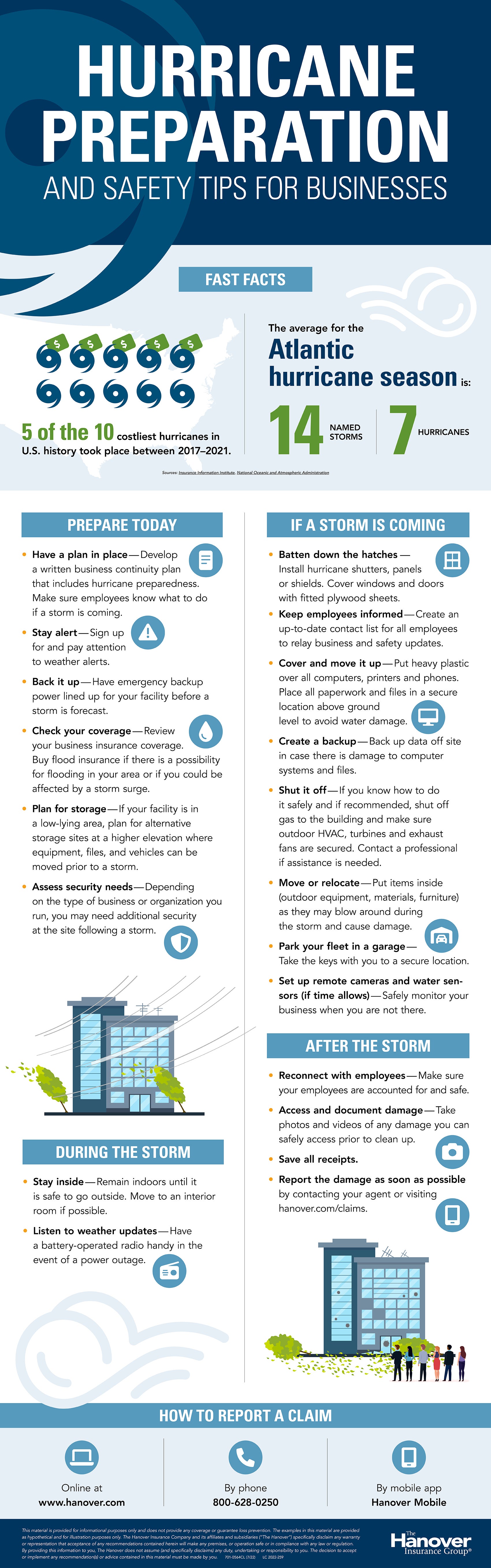

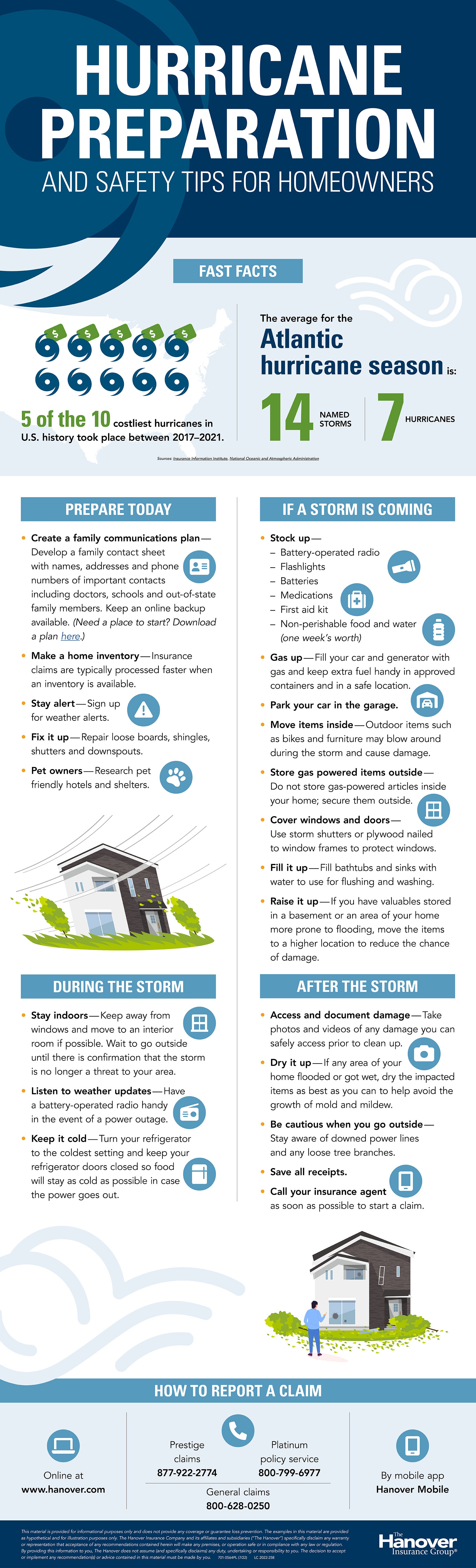

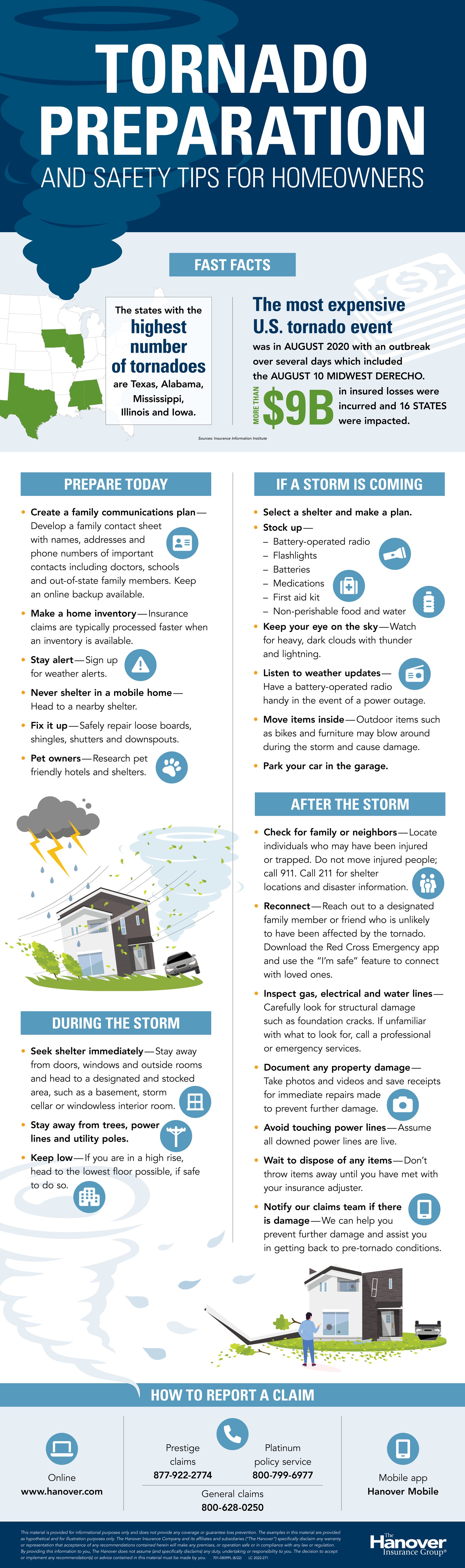

Fast facts

The states with the highest number of tornados are Texas, Alabama, Mississippi, Illinois and Iowa. (iii link)

The most expensive U.S. tornado event was in August 2020 with an outbreak over several days which included the August 10 Midwest Deracho. Over $9 billion in insured losses were incurred and 16 states were impacted. (iii link)Prepare today

Create a family communications plan – Develop a family contact sheet with names, addresses and phone numbers of important contacts including doctors, schools and out-of-state family members. Keep an online backup available. (Need a place to start? Download a plan here.)

Make a home inventory – Insurance claims are typically process faster when an inventory is available.

Stay alert - Sign up for weather alerts.

Never shelter in a mobile home - Head to a nearby shelterFix it up - Repair loose boards, shingles, shutters and downspouts.

Pet owners – Research pet friendly hotels and shelters.If a storm is coming

Select a shelter and make a plan.

Stock up –

Battery-operated radio

Flashlights

Batteries

Medications

First aid kit

Non-perishable food and water

See a suggested list from the Red Cross.

Keep your eye on the sky – Watch for heavy, dark clouds with thunder and lightning.

Listen to weather updates – Have a battery-operated radio handy in the event of a power outage.

Move items inside – Outdoor items such as bikes and furniture may blow around during the storm and cause damage.

Park your car in the garage.During the storm

Seek shelter immediately – Stay away from doors, windows and outside rooms and head to a designated and stocked area, such as a basement, storm cellar or windowless interior room.

Never shelter in a mobile home – Head to a nearby shelter.

Stay away from trees, power lines and utility poles.

Keep low – If you are in a high rise, head to the lowest floor possible.

After the storm

Check for family or neighbors – Locate individuals who may have been injured or trapped. Do not move injured people; call 911. Call 211 for shelter locations and disaster information.

Reconnect – Reach out to a designated family member or friend who is unlikely to have been affected by the tornado. Register on the Red Cross Safe and Well website.

Inspect gas, electrical and water lines – Carefully look for structural damage such as foundation cracks. If unfamiliar with what to look for, call a professional or emergency services.

Document any property damage – Take photos and videos and save receipts for immediate repairs made to prevent further damage.

Avoid touching power lines – Assume all downed power lines are live.

Wait to dispose of any items – Don’t throw items away until you have met with your insurance adjuster.

Notify our claims team if there is damage – We can help you prevent further damage and assist you in getting back to pre-tornado conditions.How to report a claim

Online at www.hanover.com

Prestige claims:877-922-2774

Platinum policy service: 800-799-6977

General claims: 800-628-0250

By mobile app: Hanover mobileThis material is provided for informational purposes only and does not provide any coverage or guarantee loss prevention. The examples in this material are provided as hypothetical and for illustration purposes only. The Hanover Insurance Company and its affiliates and subsidiaries (“The Hanover”) specifically disclaim any warranty or representation that acceptance of any recommendations contained herein will make any premises, or operation safe or in compliance with any law or regulation. By providing this information to you, The Hanover does not assume (and specifically disclaims) any duty, undertaking or responsibility to you. The decision to accept or implement any recommendation(s) or advice contained in this material must be made by you.

Tornado preparation and safety tips for homeowners

Learn ways to prepare your home before, during and after a tornado.

Sources:

Insurance Information Institute

These essential tips, developed by The Hanover, provide important guidelines to help you prevent the most common weather-related damage that may occur during a tornado. Bookmark this page to refer to these tips regularly, to help avoid or reduce the effects of a tornado on your home and vehicles.