You have probably noticed higher prices in many areas of your life – from what you pay at the gas pump to the grocery store, for shipping and more. Home insurance rates are not immune to this trend.

Across the industry in most markets and with most insurance companies, whether you’ve had a claim or not, home insurance premiums are rising due to a variety of factors. Many of these factors are out of your control, as well as your agent’s and insurance company’s.

What factors influence home insurance rates?

Rates are determined by the likelihood of a homeowner filing a claim and the potential risks involved. Home insurance rates are driven by numerous standard factors, including:

- Amount of coverage needed

- Age of the home

- Location

- Liability issues

- Previous claims

There are other influencers caused by national trends which also contribute to rates. The biggest cause of rates going up is the rise in inflation. When prices rise, the cost of living and owning a home increases, which in turn influences home insurance rates. These rate increases are happening in insurance companies across the country.

To give you a glimpse into some of the factors causing rates to rise, we have compiled insights on nationwide trends.

Jump to: More severe weather |Higher material costs | Increased shipping costs and delays | Higher labor | Bigger, upscale homes | Increase in fire damage | Increase in water damage

More severe weather

From windstorms to hail events, extensive freezing spells and torrential rains, most of the country is experiencing more frequent and more extreme weather events that lead to more damage and higher overall insurance costs.

- There were 18 weather/climate disaster events in the U.S. in 2021 with losses exceeding $1 billion in damage1.

- With an annual average of seven events from 1980-2020, the increase in severe weather caused 39% of all U.S. home insurance claims2.

- According to a nationwide survey of 2,500 homeowners conducted by the Center for Insurance Policy and Research (CIPR), more than two-thirds of respondents said they were aware of things they could do to protect their property from extreme weather events to reduce their risk, but this awareness does not necessarily translate into action. Only half had made changes.3

- The CIPR study also found that two-thirds of respondents said their homeowners insurance costs have gone up over the past three years, with “increase in natural disasters such as hurricanes and wildfires” indicated as a key reason believed to be driving the increase. 4

Coverage to consider

Not all home insurance is created equally. Your independent agent can recommend added value coverage that enhances your protection and the restoration process should weather damage your home.

Higher material costs

From record high prices to shortages of materials, the home building industry has seen lengthy delays, increased prices and a large number of postponed projects. These higher prices for construction projects, renovations and repairs lead to higher costs for homeowners.

- With the price of building materials, such as drywall, shingles, lumber and copper wiring, up an average of 26%, homes have become more expensive to fix and replace. According to a survey completed by the National Association of Home Builders5, this is the largest single year increase in the survey’s history.

- Ninety three percent of contractors are impacted by the increased price of materials which leads to higher replacement cost when insurance claims are filed.6

How market value is different from replacement value

The market value of a home is different from the replacement cost of the home. Market value is the amount a buyer is willing to pay for a home. Replacement cost refers to the amount it would take to completely rebuild a home at the current price of labor and materials. With rising prices and more severe damage caused by weather and other factors, additional coverage may be needed.

Coverage to consider:

Increased shipping costs and delays

The pandemic has impacted almost every part of the global supply chain causing shipping delays and higher prices. When shipping ports get overwhelmed and backed up, it impacts the time it takes to get materials to homeowners and the cost of delivering the materials. From appliances to plumbing fixtures, it’s taken weeks and months longer to get building supplies, which previously had taken days to get.

- 94% of Fortune 1000 companies have reported supply chain disruptions from COVID-19.7

- Globally, RBC Capital Markets reported 77% of ports are experiencing abnormally long times to turnaround traffic.8

- In fact, Freightos.com marketplace data shows that in September 2021, China-US ocean shipments took an average of 73 days to arrive at their final destination, 83% longer than in September 20199

Do you have enough coverage?

Now is the time to talk to your independent agents about Additional living expense coverage. Additional living expenses coverage (ALE) is the money you’ll need to live elsewhere if forced from your home due to fire or any disaster covered by your homeowner’s insurance policy.

ALE coverage pays for expenses beyond your “normal” costs at home.

This coverage is available to reimburse you for the extra costs to maintain the lifestyle you had before. For example: hotel bills, restaurant meals, emergency clothing, laundry service, pet boarding, storage, furniture rental for items you’re accustomed to having, and much more.

With postponements and delays, be sure to review your ALE coverage and make sure you have enough so you are supported when you need it.

Higher labor costs

Builders often hire sub-contractors who handle electrical, drywall, plumbing and other areas of construction. With the current labor shortages, higher costs are needed to secure skilled laborers or obtain the needed materials. This in turn has forced home builders to factor in higher costs for construction and remodeling work.

- Eighty-nine percent of contractors are having a hard time finding craft workers and 88% of firms are experiencing project delays.10

- Additionally, the U.S. is seeing a drop in the number of Americans becoming tradespeople. The National Electrical Contractors Association reports that 7,000 electricians join the field annually, but 10,000 retire.11 This shortfall results in higher prices and longer wait times for home projects.

Bigger, upscale homes

Many homeowners continue to increase their budget and the size of their projects for a more upscale result with custom cabinetry, granite, hardwood floors, finished basements and more. Higher-end renovations lead to higher replacement costs when damages arise.

- According to the National Kitchen and Bath Association, 62% of their design firm members reported an increase in the scope and size of their projects prior to 2020.12

- The home improvement industry has seen a 30% growth in luxury home products, showing that homeowners are willing to spend more to renovate with high end products.13

Higher end renovations may mean higher replacement costs

There are many reasons why homeowners renovate their homes. Whether it’s to improve and increase their home’s value or to update its style and efficiency, home improvements take time, money and patience. While all homeowners need to protect their homes, these types of updates may increase the value of your home and require additional protection.

Coverage to consider:

Increase in fire damage

Fires cause devastation, destruction, casualties and more. Most home fires and fire casualties result from five causes: cooking, heating, electrical distribution and lighting equipment, intentional fire setting, and smoking materials.14 While there are fewer home fires than there were 40 years ago, more damage is caused by fires today.15

- Newer homes burn nearly 6x faster than older ones due to the use of synthetic materials and open-floor plans, according to Underwriters Laboratories. This results in more total losses from fire and higher rebuild costs.16

- The average fire loss in 2020 was 1.5 times higher at $24,700 per fire compared to $16,300 per fire in 1980 (adjusted for inflation), according to the National Fire Prevention Association.17

Increase in water damage

Whether it be leaking or burst pipes, plumbing issues, sewage backups, pump overflows, clogged gutters, ice dams or extreme weather conditions, water damage can not only lead to mold, wet carpets and a bad smell – but to health issues as well.

- About one in 50 insured homes has a property damage claim caused by water damage or freezing each year with the average claim around $10,900.18

- Water damage and freezing losses have increased by more than 10% from 2017 to 2019.19

Are water backup damage incidents covered by home insurance?

Not all home insurance policies provide coverage for water backup damage. Water backup and sump pump overflow coverage is often an additional option. This coverage provides extra protection against water damage caused by backed up drains or a sump pump failure.

Coverage to consider:

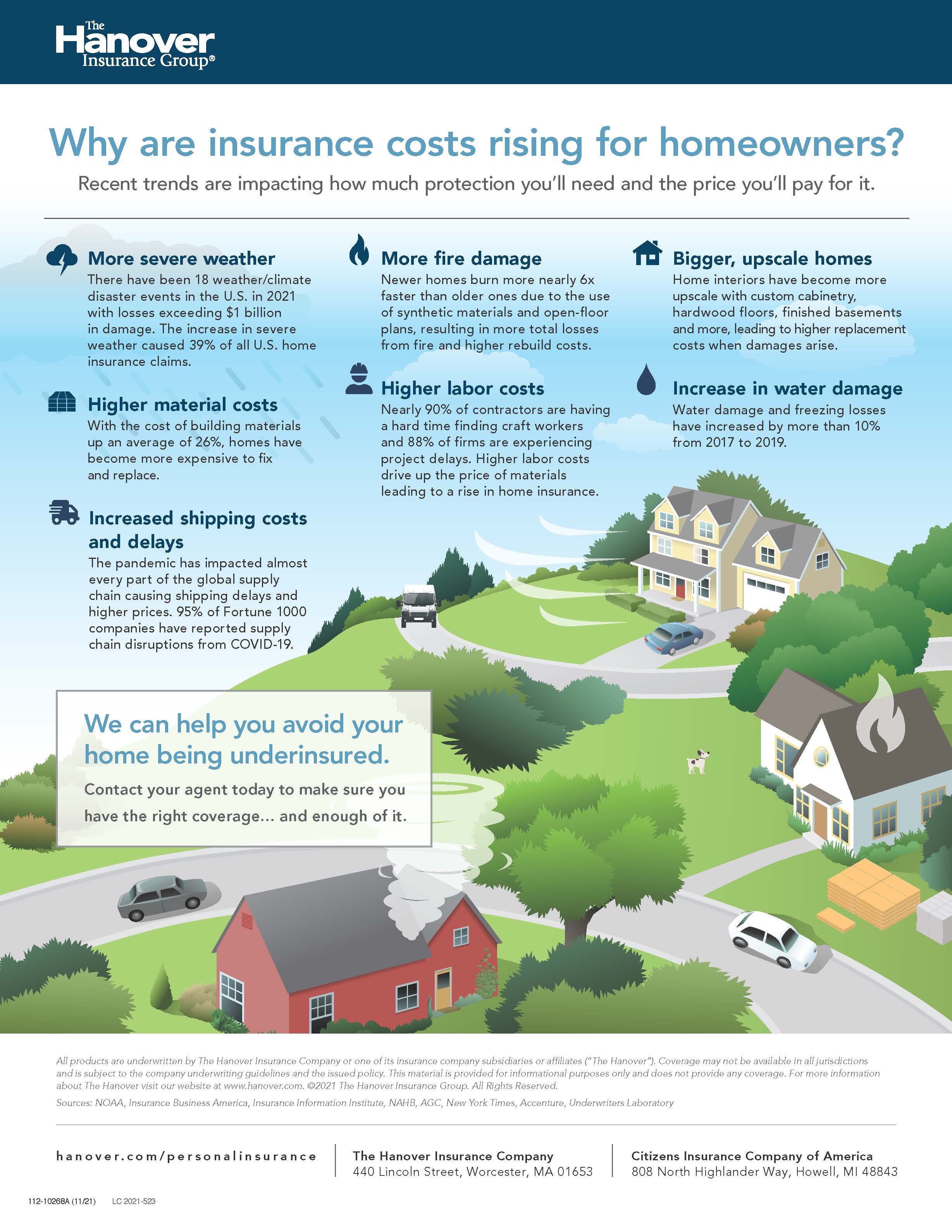

An overview of these trends can be viewed on our Why are insurance costs rising for homeowners infographic.

Working with an independent agent will help ensure you have the right coverage with The Hanover’s suite of products.

Questions? Contact your independent agent to learn more.

Find an agent

Sources

[1] National Centers for Environmental Information [2] Insurance Business Magazine [3] CIPR Consumer Property Insurance Report [4] CIPR Consumer Property Insurance Report [5] National Association of Home Builders [6] Associated General Contractors of America [7]Accenture [8] Bloomberg [9]Freightos [10] Associated General Contractors of America [11] Forbes [12] Forbes [13] Forbes [14] National Fire Prevention Association [15] National Fire Prevention Association [16] Associated Press [17] National Fire Prevention Association [18] Insurance Information Institute [19] Insurance Information Institute