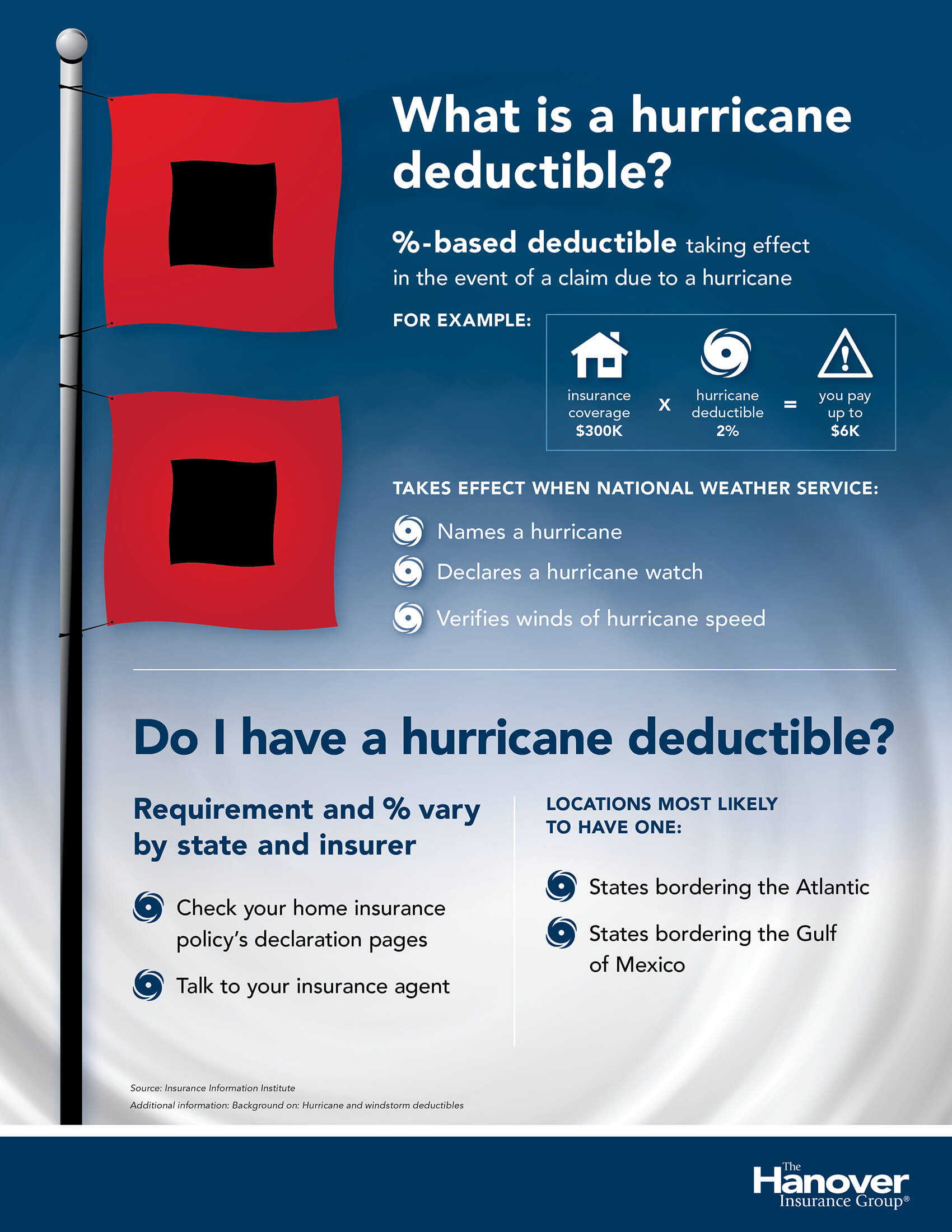

Understanding hurricane deductibles

According to a survey conducted by the Insurance Research Council in 2017, more than 1/3rd of homeowners in some coastal states have never heard of a hurricane deductible.

If you live in an Atlantic coast or gulf state, you should review your home insurance policy with your agent to see if you have a hurricane deductible and how much it is. You can also discuss coverage options that may come in handy in the event of a hurricane, such as waiver of deductible, siding and roof restoration coverage, and refrigerated products coverage, all of which are offered by The Hanover.

In the meantime, you can learn more about hurricane deductibles above.

Source: Insurance Information Institute

Additional information: Background on: Hurricane and windstorm deductibles

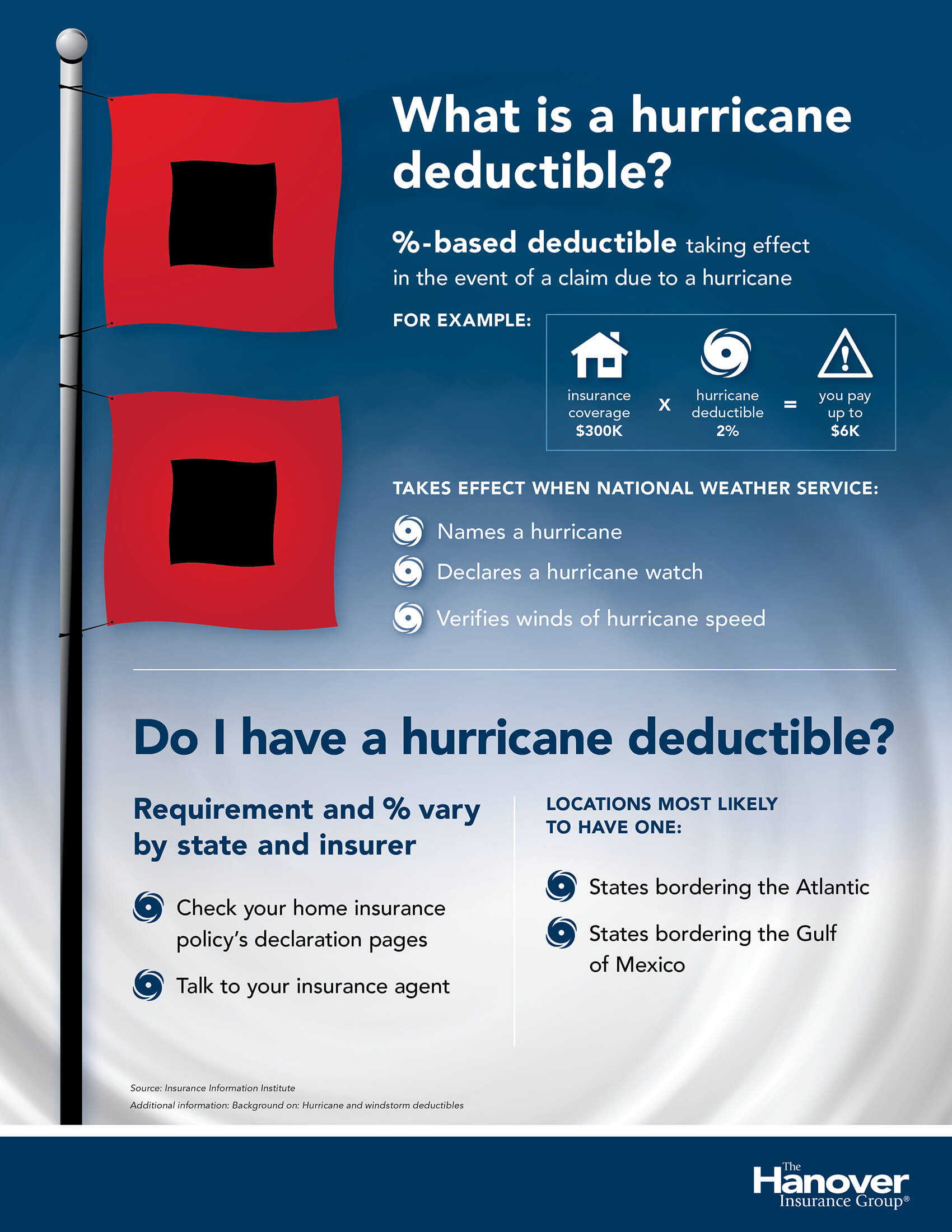

Understanding hurricane deductibles

According to a survey conducted by the Insurance Research Council in 2017, more than 1/3rd of homeowners in some coastal states have never heard of a hurricane deductible.

If you live in an Atlantic coast or gulf state, you should review your home insurance policy with your agent to see if you have a hurricane deductible and how much it is. You can also discuss coverage options that may come in handy in the event of a hurricane, such as waiver of deductible, siding and roof restoration coverage, and refrigerated products coverage, all of which are offered by The Hanover.

In the meantime, you can learn more about hurricane deductibles above.

Source: Insurance Information Institute

Additional information: Background on: Hurricane and windstorm deductibles

Understanding hurricane deductibles

According to a survey conducted by the Insurance Research Council in 2017, more than 1/3rd of homeowners in some coastal states have never heard of a hurricane deductible.

If you live in an Atlantic coast or gulf state, you should review your home insurance policy with your agent to see if you have a hurricane deductible and how much it is. You can also discuss coverage options that may come in handy in the event of a hurricane, such as waiver of deductible, siding and roof restoration coverage, and refrigerated products coverage, all of which are offered by The Hanover.

In the meantime, you can learn more about hurricane deductibles above.

Source: Insurance Information Institute

Additional information: Background on: Hurricane and windstorm deductibles

- Infographic transcript

-

What is a hurricane deductible?

Percentage-based deductible taking effect in the event of a claim due to a hurricane

For example: insurance coverage $300K X hurricane deductible 2% = you pay up to $6K

Takes effect when national weather service:

- Names a hurricane

- Declares a hurricane watch

- Verifies winds of hurricane speed

Do I have a hurricane deductible?

Requirement and % vary by state and insurer- Check your home insurance policy's declaration pages

- Talk to your insurance agent

- States bordering the Atlantic

- States bordering the Gulf of Mexico

Understanding hurricane deductibles

According to a survey conducted by the Insurance Research Council in 2017, more than 1/3rd of homeowners in some coastal states have never heard of a hurricane deductible.

If you live in an Atlantic coast or gulf state, you should review your home insurance policy with your agent to see if you have a hurricane deductible and how much it is. You can also discuss coverage options that may come in handy in the event of a hurricane, such as waiver of deductible, siding and roof restoration coverage, and refrigerated products coverage, all of which are offered by The Hanover.

In the meantime, you can learn more about hurricane deductibles above.

Source: Insurance Information Institute

Additional information: Background on: Hurricane and windstorm deductibles