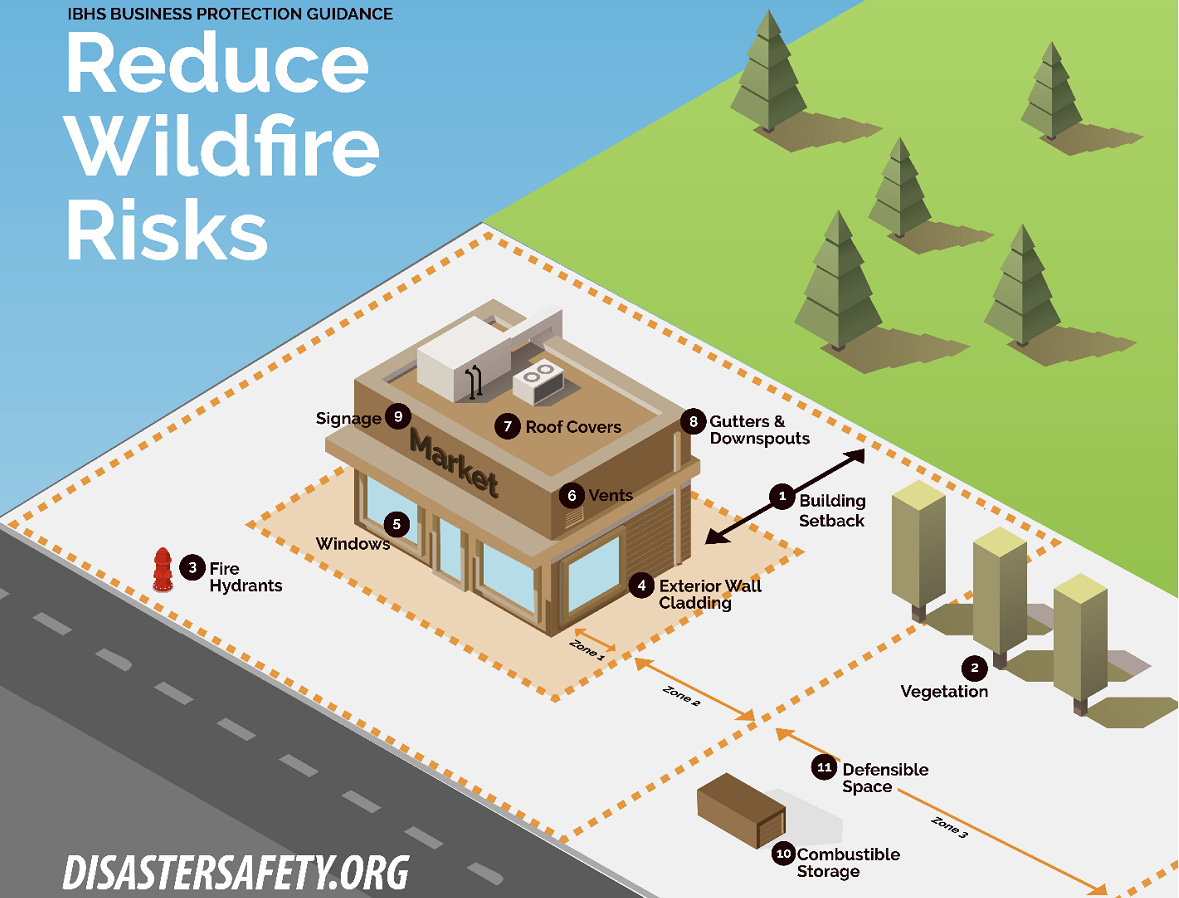

Last-minute wildfire pre-evacuation checklist for businesses

When a wildfire threatens, follow these last-minute steps developed by The Insurance Institute for Business and Home Safety (IBHS) to reduce damage to your business.

Stay safe. Always evacuate if you feel it’s unsafe to stay. DO NOT wait to receive an emergency notification if you feel threatened from a fire.

If wildfires may be nearby, put your Business Continuity Plan (OFB- EZ) and Emergency Preparedness Plan (EZ-PREP) into action. Begin last-minute preparations. Note that employees may need time to prep their homes as well.

Install your fire-resistant shutters. If you do not have fire-resistant shutters, installing ½-inch plywood will provide an extra measure of protection from radiant heat and windblown embers (but not flames).

Move pallets, tables and chairs, benches, outdoor equipment, signage, inventory, and loose items inside.

For apartment and condominium complexes, request all residents to clear balconies, porches, and breezeways of all items including furniture and plants.

Shut off HVAC to keep out smoke.

Close doors and windows.Shut all interior and exterior doors and windows. Close commercial garage doors all the way.

Cover vents. If your vents are easily accessible and you do not have the metal mesh covers, a lightweight material (such as sheet metal or ½- inch plywood) can be installed. These covers should be removed once the fire front passes.

Leave your property easily seen and accessible for firefighters. Open your gate(s), leave a ladder, and leave your lights on so they can see your building under smoky conditions.

Evacuate.

Source: The Insurance Institute for Business and Home Safety

The recommendation(s), advice and contents of this material are provided for informational purposes only and do not purport to address every possible legal obligation, hazard, code violation, loss potential or exception to good practice. The Hanover Insurance Company and its affiliates and subsidiaries ("The Hanover") specifically disclaim any warranty or representation that acceptance of any recommendations or advice contained herein will make any premises, property or operation safe or in compliance with any law or regulation. Under no circumstances should this material or your acceptance of any recommendations or advice contained herein be construed as establishing the existence or availability of any insurance coverage with The Hanover. By providing this information to you, The Hanover does not assume (and specifically disclaims) any duty, undertaking or responsibility to you. The decision to accept or implement any recommendation(s) or advice contained in this material must be made by you

LC 2021-360

Last-minute wildfire pre-evacuation checklist for businesses

When a wildfire threatens, follow these last-minute steps developed by The Insurance Institute for Business and Home Safety (IBHS) to reduce damage to your business.

Stay safe. Always evacuate if you feel it’s unsafe to stay. DO NOT wait to receive an emergency notification if you feel threatened from a fire.

If wildfires may be nearby, put your Business Continuity Plan (OFB- EZ) and Emergency Preparedness Plan (EZ-PREP) into action. Begin last-minute preparations. Note that employees may need time to prep their homes as well.

Install your fire-resistant shutters. If you do not have fire-resistant shutters, installing ½-inch plywood will provide an extra measure of protection from radiant heat and windblown embers (but not flames).

Move pallets, tables and chairs, benches, outdoor equipment, signage, inventory, and loose items inside.

For apartment and condominium complexes, request all residents to clear balconies, porches, and breezeways of all items including furniture and plants.

Shut off HVAC to keep out smoke.

Close doors and windows.Shut all interior and exterior doors and windows. Close commercial garage doors all the way.

Cover vents. If your vents are easily accessible and you do not have the metal mesh covers, a lightweight material (such as sheet metal or ½- inch plywood) can be installed. These covers should be removed once the fire front passes.

Leave your property easily seen and accessible for firefighters. Open your gate(s), leave a ladder, and leave your lights on so they can see your building under smoky conditions.

Evacuate.

Source: The Insurance Institute for Business and Home Safety

The recommendation(s), advice and contents of this material are provided for informational purposes only and do not purport to address every possible legal obligation, hazard, code violation, loss potential or exception to good practice. The Hanover Insurance Company and its affiliates and subsidiaries ("The Hanover") specifically disclaim any warranty or representation that acceptance of any recommendations or advice contained herein will make any premises, property or operation safe or in compliance with any law or regulation. Under no circumstances should this material or your acceptance of any recommendations or advice contained herein be construed as establishing the existence or availability of any insurance coverage with The Hanover. By providing this information to you, The Hanover does not assume (and specifically disclaims) any duty, undertaking or responsibility to you. The decision to accept or implement any recommendation(s) or advice contained in this material must be made by you

LC 2021-360

Last-minute wildfire pre-evacuation checklist for businesses

When a wildfire threatens, follow these last-minute steps developed by The Insurance Institute for Business and Home Safety (IBHS) to reduce damage to your business.

Stay safe. Always evacuate if you feel it’s unsafe to stay. DO NOT wait to receive an emergency notification if you feel threatened from a fire.

If wildfires may be nearby, put your Business Continuity Plan (OFB- EZ) and Emergency Preparedness Plan (EZ-PREP) into action. Begin last-minute preparations. Note that employees may need time to prep their homes as well.

Install your fire-resistant shutters. If you do not have fire-resistant shutters, installing ½-inch plywood will provide an extra measure of protection from radiant heat and windblown embers (but not flames).

Move pallets, tables and chairs, benches, outdoor equipment, signage, inventory, and loose items inside.

For apartment and condominium complexes, request all residents to clear balconies, porches, and breezeways of all items including furniture and plants.

Shut off HVAC to keep out smoke.

Close doors and windows.Shut all interior and exterior doors and windows. Close commercial garage doors all the way.

Cover vents. If your vents are easily accessible and you do not have the metal mesh covers, a lightweight material (such as sheet metal or ½- inch plywood) can be installed. These covers should be removed once the fire front passes.

Leave your property easily seen and accessible for firefighters. Open your gate(s), leave a ladder, and leave your lights on so they can see your building under smoky conditions.

Evacuate.

Source: The Insurance Institute for Business and Home Safety

The recommendation(s), advice and contents of this material are provided for informational purposes only and do not purport to address every possible legal obligation, hazard, code violation, loss potential or exception to good practice. The Hanover Insurance Company and its affiliates and subsidiaries ("The Hanover") specifically disclaim any warranty or representation that acceptance of any recommendations or advice contained herein will make any premises, property or operation safe or in compliance with any law or regulation. Under no circumstances should this material or your acceptance of any recommendations or advice contained herein be construed as establishing the existence or availability of any insurance coverage with The Hanover. By providing this information to you, The Hanover does not assume (and specifically disclaims) any duty, undertaking or responsibility to you. The decision to accept or implement any recommendation(s) or advice contained in this material must be made by you

LC 2021-360

Last-minute wildfire pre-evacuation checklist for businesses

When a wildfire threatens, follow these last-minute steps developed by The Insurance Institute for Business and Home Safety (IBHS) to reduce damage to your business.

Stay safe. Always evacuate if you feel it’s unsafe to stay. DO NOT wait to receive an emergency notification if you feel threatened from a fire.

If wildfires may be nearby, put your Business Continuity Plan (OFB- EZ) and Emergency Preparedness Plan (EZ-PREP) into action. Begin last-minute preparations. Note that employees may need time to prep their homes as well.

Install your fire-resistant shutters. If you do not have fire-resistant shutters, installing ½-inch plywood will provide an extra measure of protection from radiant heat and windblown embers (but not flames).

Move pallets, tables and chairs, benches, outdoor equipment, signage, inventory, and loose items inside.

For apartment and condominium complexes, request all residents to clear balconies, porches, and breezeways of all items including furniture and plants.

Shut off HVAC to keep out smoke.

Close doors and windows.Shut all interior and exterior doors and windows. Close commercial garage doors all the way.

Cover vents. If your vents are easily accessible and you do not have the metal mesh covers, a lightweight material (such as sheet metal or ½- inch plywood) can be installed. These covers should be removed once the fire front passes.

Leave your property easily seen and accessible for firefighters. Open your gate(s), leave a ladder, and leave your lights on so they can see your building under smoky conditions.

Evacuate.

Source: The Insurance Institute for Business and Home Safety

The recommendation(s), advice and contents of this material are provided for informational purposes only and do not purport to address every possible legal obligation, hazard, code violation, loss potential or exception to good practice. The Hanover Insurance Company and its affiliates and subsidiaries ("The Hanover") specifically disclaim any warranty or representation that acceptance of any recommendations or advice contained herein will make any premises, property or operation safe or in compliance with any law or regulation. Under no circumstances should this material or your acceptance of any recommendations or advice contained herein be construed as establishing the existence or availability of any insurance coverage with The Hanover. By providing this information to you, The Hanover does not assume (and specifically disclaims) any duty, undertaking or responsibility to you. The decision to accept or implement any recommendation(s) or advice contained in this material must be made by you

LC 2021-360